what is suta tax texas

9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. SUTA stands for State Unemployment Tax Act.

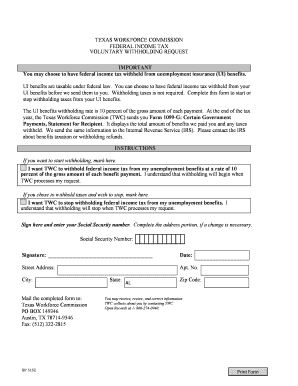

Texas Unemployment Benefits Application Form Fill Online Printable Fillable Blank Pdffiller

Also what is the Texas state unemployment tax rate.

. Assume that your company receives a good assessment and your. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the. 1 hour agoTexas Caroline Harris becomes youngest Republican woman ever elected to the state House Harris primarily ran a campaign focused on property taxes border security the pro.

The states SUTA wage base is 7000 per employee. Each state sets a range of minimum and maximum tax rates for SUTA taxes. What Is Texas State Unemployment Tax Rate.

A typical SUTA rate ranges from 2-4. Since your business has no history of laying off employees your SUTA tax rate is 3. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

The Suta Rate for 2021 is 508. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. Also employers should be aware of certain occasions.

It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor. Texas SUI Rate State Unemployment Insurance SUI Employers should use the benefit ratio formula for SUI. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

The Texas state unemployment tax rate is 825. In such a case the tax is applied to the first 7000 in wages paid to. Each of these employees earns an annual taxable income of 10000 bringing the total wages to 100000.

The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must. Unlike Social Security and Medicare employees dont share this tax liability with their employers. General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training.

Wage base is 9000. The yearly cost is. Each state establishes its.

How Is Unemployment Tax Rate Calculated. An employers SUI rate is the sum of five components. Heres how an employer in Texas would calculate SUTA.

While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a maximum of 631 percent it is not all good news for employers. You have employees with the.

.jpg)

Tx State Wage Report Requires E Filing Das

What Are Employer Taxes And Employee Taxes Gusto

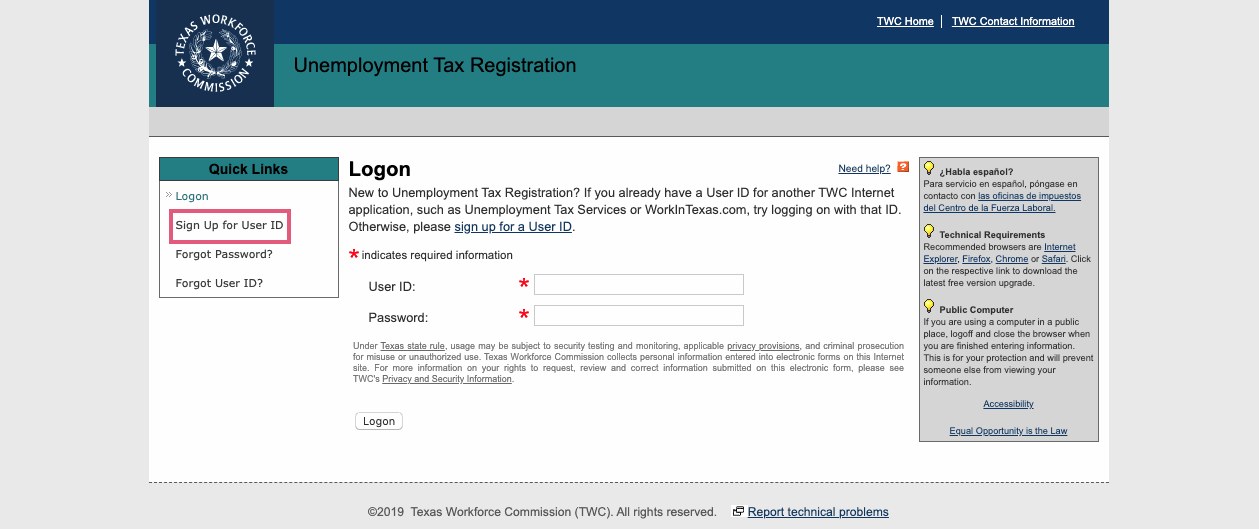

Quickfile User S Guide Choosing The File Type Twc

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Learn More About How This Texas Nonprofit Saved Half A Million Dollars On Unemployment Insurance First Nonprofit Companies

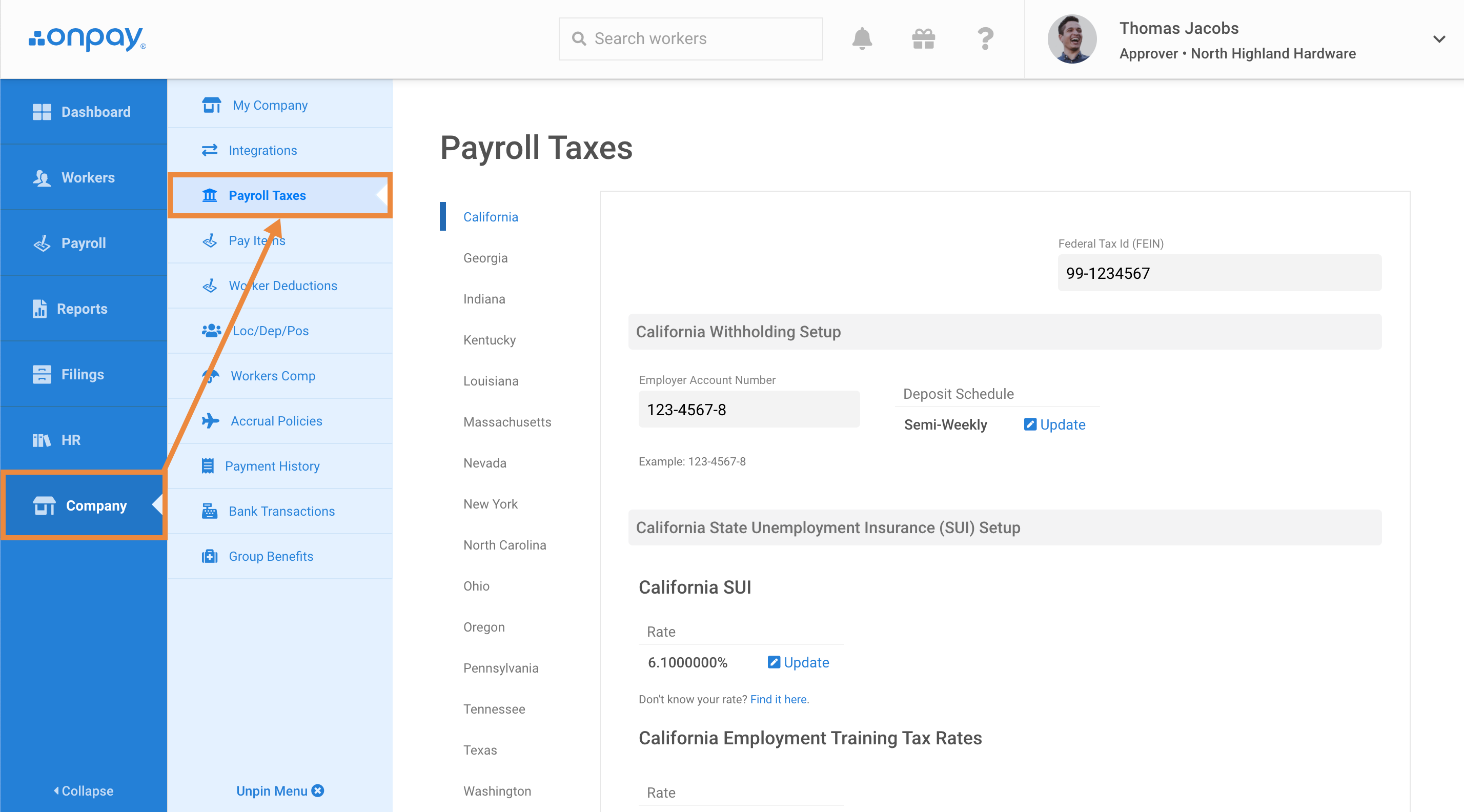

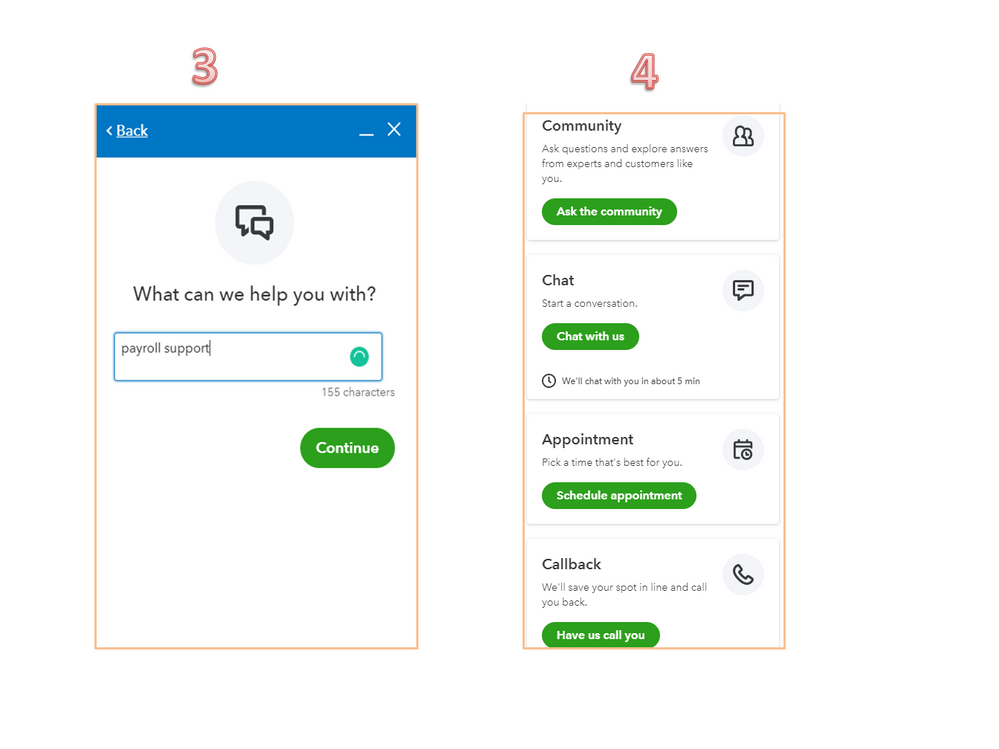

How To Update Your Sui Tax Rates And Deposit Schedule Help Center Home

Disability Rights Texas Are You One Of The Over 23 Million U S Workers That Filed For Unemployment In 2020 This Week The Irs Announced That They Will Be Recalculating Taxes On

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Texas Workforce Commission Lowers Employer Tax Rates For 2020 Corridor News

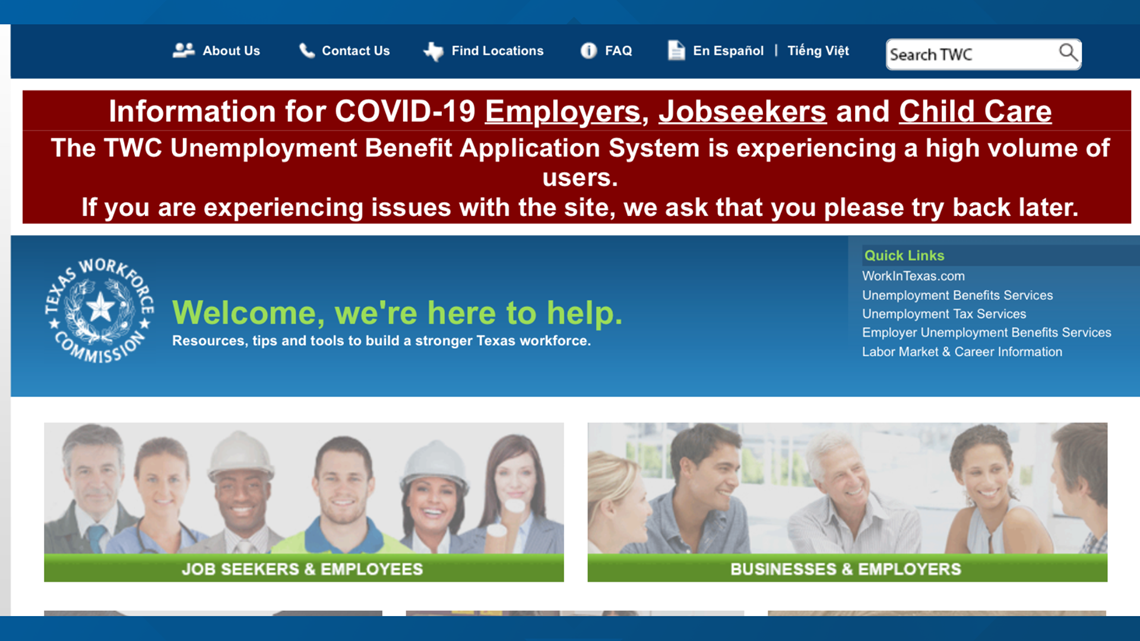

Texas Workforce Commission Hogg Foundation For Mental Health

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel And Lodging

Usa State Payroll Rates Resources State Of Texas Unemployment Insurance Reporting Payments

/https://static.texastribune.org/media/images/2015/08/19/31-Days-26-UnemploymentTax.jpg)

Employee Outsourcing Firms Get Tax Break The Texas Tribune

Unemployment Benefits Texas Tx Eligibility Claims

I Am A Tx Nonprofit With One Employee In Sc The State Of Tx Says I Do Not Need Need To File For Unemployment Tax How Do I Stop Qb Asking Me

Texas Workforce Commission Launches New Process For Handling Unemployment Claims Khou Com

Webinar Unemployment Tax Rates Upcoming Events News Events Subcontractors Association Of The Metroplex Sam